|

|

BankHeadOffice.com

|

|

♦

Loan Calculators ♦ Mortgage Guides ♦ Banking FAQs ♦ Banking Institutions ♦ Central Banks Worldwide |

|

|

|

|

|||||

Bank of Baroda

Bank of Baroda (BoB) is the third largest bank in India, after the State Bank of India and the Punjab National Bank and ahead of ICICI Bank. It offers a wide range of banking products and financial services to corporate and retail customers through a variety of delivery channels and through its specialised subsidiaries and affiliates in the areas of investment banking, credit cards and asset management. As of August 2010, the bank has 78 branches abroad and by the end of FY11 this number should climb to 90. In 2010, BOB opened a branch in Auckland, New Zealand, and its tenth branch in the United Kingdom. The bank also plans to open five branches in Africa. Besides branches, BoB plans to open three outlets in the Persian Gulf region that will consist of ATMs with a couple of people.

|

|

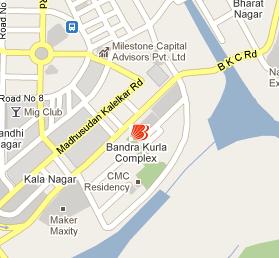

Bank of Baroda Head

Office Baroda Corporate Centre, C-26, G-Block, Bandra-Kurla Complex, Bandra (East), Mumbai-400 051 Tel :(022) 6698 5000 - 04 Swift Code : BARBINBB |

|

Bank of Baroda is one of 20 major nationalised commercial banks in India. Nationalised banks dominate the banking system in India. The major objective behind nationalisation was to spread banking infrastructure in rural areas and make cheap finance available to Indian farmers. With this, the Government of India held a control over 91% of the banking industry in India. After the nationalisation of banks there was a huge jump in the deposits and advances with the banks.

|

|

|

DISCLAIMER |

|

© 2011 - 2022 BankHeadOffice.com ® All Rights Reserved |