|

|

BankHeadOffice.com

|

|

♦

Loan Calculators ♦ Mortgage Guides ♦ Banking FAQs ♦ Banking Institutions ♦ Central Banks Worldwide |

|

|

|

|

|||||

Bank Internasional Indonesia

Bank Internasional Indonesia (BII) is among the top 10 largest commercial banks in Indonesia and is a 97%-owned subsidary of Maybank. The bank provides a full range of financial services through its 327 branches across Indonesia together with a network of 937 ATMs as well as phone banking and internet banking channels. BII is listed on the Indonesia Stock Exchange (BNII) and is active in SME/Commercial, Consumer and Corporate banking. BII provides products and services to medium and commercial size enterprises and individuals with credit cards, mortgages, deposit, lending, and wealth management services. Corporate clients are provided with services in lending, trade finance, cash management, custody, and foreign exchange.

Bank Internasional Indonesia is

in the process of closing its banking business in India.

Dated this 20th Day of September 2007.

|

|

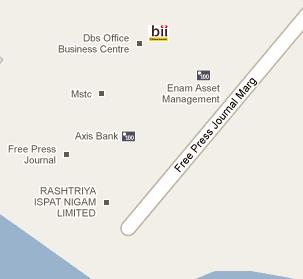

BII India Head Office Ground Floor Raheja Chambers 213, Nariman Point Mumbai 400 021 Website: www.bii.co.id

Banking Hours: Swift Code : IBBKINBB

|

|

Foreign banks

like Bank

Internasional Indonesia have brought latest technology and latest

banking practices in India. They have helped made Indian Banking system more

competitive and efficient. Government has come up with a road map for

expansion of foreign banks in India. The road map has two phases. During the

first phase between March 2005 and March 2009, foreign banks may establish a

presence by way of setting up a wholly owned subsidiary (WOS) or conversion

of existing branches into a WOS.

The second phase commenced on April 2009 after a review of the experience

gained after due consultation with all the stake holders in the banking

sector. The review has examined issues concerning extension of national

treatment to WOS, dilution of stake and permitting mergers/acquisitions of

any private sector banks in India by a foreign bank.

|

|

|

DISCLAIMER |

|

© 2011 - 2022 BankHeadOffice.com ® All Rights Reserved |