|

|||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||

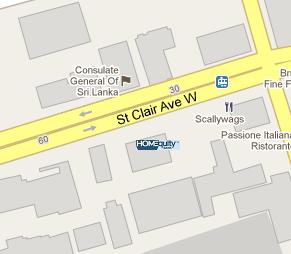

| Home » Banking in Canada » HomEquity Bank | |||||||||||||||||||||||||||

HomEquity Bank |

|||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||

|

|

HomEquity Bank, a Schedule I Canadian Bank, is the only national provider of reverse mortgages to Canadian seniors. HomEquity Bank originates and administers its reverse mortgage solutions under the CHIP Home Income Plan brand. |

|

|||||||||||||||||||||||||

|

HomEquity Bank’s predecessor, Canadian Home Income Plan Corporation (CHIP), founded in 1986, pioneered the reverse mortgage concept in Canada and has been in the business for more than 20 years. Canadian Home Income Plan Corporation recently changed its name to HomEquity Bank after it received its bank charter on October 13, 2009. The CHIP Home Income Plan is a solution to the financial needs of Canadians seniors (55 years +). It is a type of residential mortgage that permits qualifying homeowners to convert a portion of their home equity into cash on a tax-free basis while remaining in the home. |

|||||||||||||||||||||||||||

|

The CHIP Home Income Plan has helped thousands of Canadian seniors who are

looking for a simple, sensible way to unlock the value in their homes -

homes that they're very comfortable in and don't want to have to sell. |

|||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||