|

|

BankHeadOffice.com

|

|

♦

Loan Calculators ♦ Mortgage Guides ♦ Banking FAQs ♦ Banking Institutions ♦ Central Banks Worldwide |

|

|

|

|

|||||

Westpac Banking Corporation

Westpac Banking Corporation is a multinational financial services, one of the Australian 'big four' banks and the second-largest bank in New Zealand. As of the merger with St. George Bank in December 2008 the bank has 10 million customers, Australia's largest branch network with almost 1200 branches and an ATM network with more than 2800 ATMs.

The bank is Australia's second largest provider of home lending and Australia's second largest provider of wealth platforms by funds under Administration. The bank is Australia's second largest business banking lender and Australia's second largest bank by assets. Westpac's core business consists of nine business units (five customer facing) through which it serves around 8.2 million customers. Westpac Retail and Business Banking includes deposit taking, transaction accounts, credit cards, mortgages, and other lending.

Westpac is a major home loan provider and also serves the financial needs of business customers with a turnover of up to $20 million. Investment, superannuation and general and life insurance products are also sold through the branch network. In the past, RBB operated as Consumer Financial Services. The name was changed when all retail products were combined into the one division.

|

|

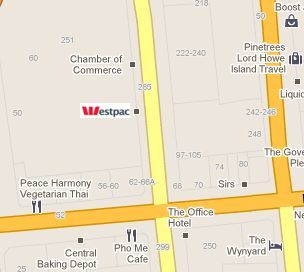

Westpac Banking Corp Head

Office 14/275 Kent Street Sydney NSW 2000 Australia Tel: +61 2 9293 9270 Fax:+61 2 8253 4128 Toll Free: 132 032 Website: www.westpac.com.au

Banking Hours: |

|

The banks are

regulated by the Australian Prudential Regulatory Authority (APRA) in

Australia. APRA is responsible for regulating much of the financial

industry, including insurance and superannuation companies. Institution

seeking to be prudentially regulated as an authorised deposit-taking

institution (ADI) is required to be authorised under the Banking Act 1959

(the Banking Act). The Australian Prudential Regulation Authority (APRA) is

responsible for the authorisation process.

Section 5 of the Banking Act defines ‘banking business’ as consisting of

both taking deposits (other than as part-payment for identified goods or

services) and making advances of money, as well as other financial

activities prescribed by regulations made under the Banking Act. The Banking

Act only allows corporations to carry on banking business in Australia,

which means APRA cannot consider applications from partnerships or

unincorporated entities. ADIs are subject to rigorous and close supervision

by APRA, which requires the ADI to comply with a range of requirements

contained in Prudential Standards and provide comprehensive data to APRA

under Reporting Standards.

|

DISCLAIMER |

|

© 2011 - 2022 BankHeadOffice.com ® All Rights Reserved |